Stop Avoiding Your Money: The 3-Minute Weekly System

Just fill out your info below to unlock instant access to Sam's complete money management system for people who've been avoiding their finances. Just $47!

One-time payment • Instant download • Keep forever

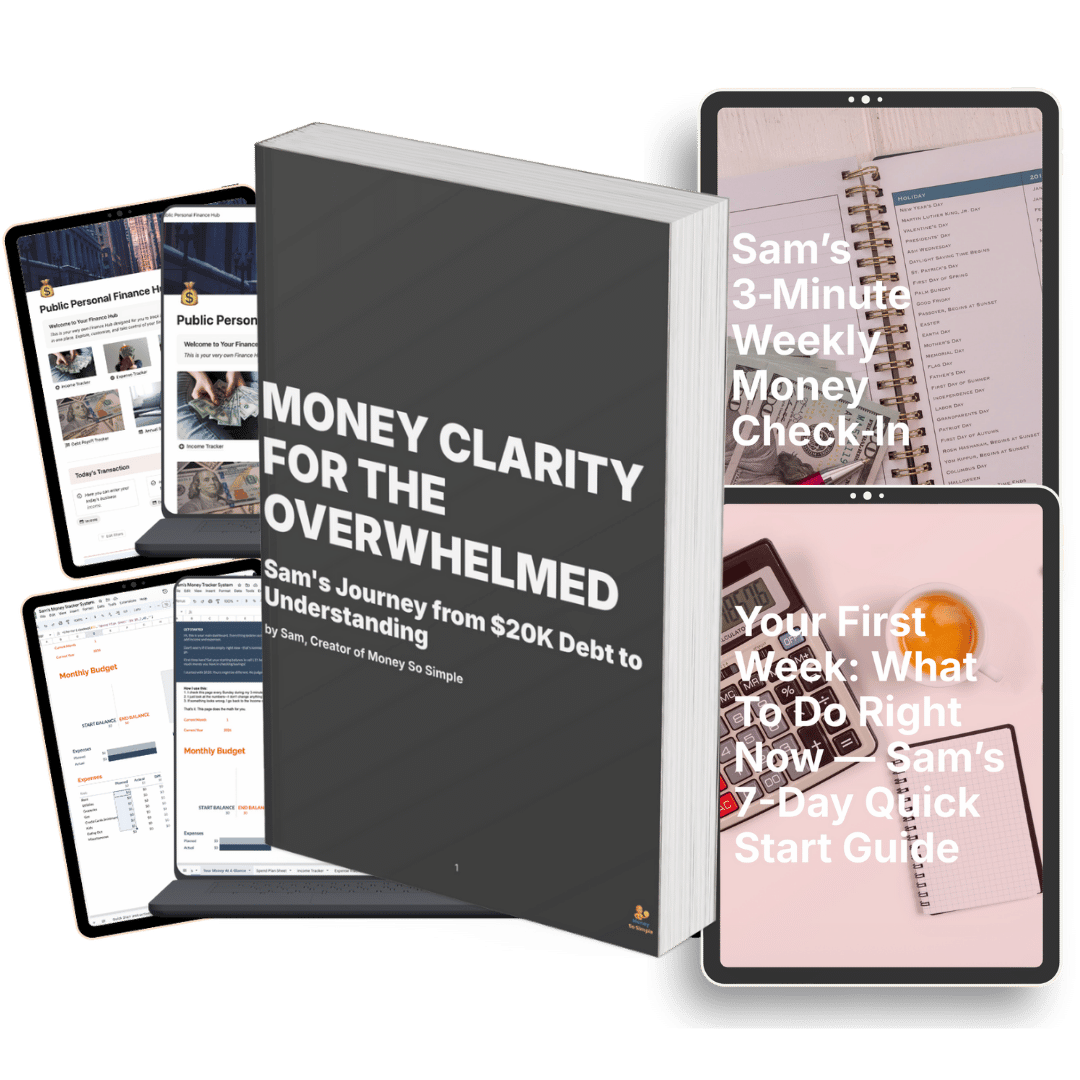

What's included?

The Complete Guide (200+ pages): an intimate, in-depth walk-through of my entire journey from avoiding my finances for 3 years to facing them every single week (from $20K in debt to awareness).

The 3-Minute Weekly Check-In: every single step you need to stop avoiding your money and build awareness without the shame spiral (This is the core of everything. If you only use one thing from this system, use this.)

Simple Money Tracker System (Excel): comprehensive spreadsheet with built-in formulas for tracking income, expenses, and debt payoff (All you do is enter numbers. The math is done for you.)

7-Day Quick Start Guide: specific instructions on how to go from "I haven't looked at my bank account in weeks" to "I've looked 5 times this week" in just 15 minutes per day (This removes the overwhelm of starting.)

Part 1 - My Story: clear guidance on why avoiding happens, why intelligence doesn't equal financial success, and why you're not alone in this struggle (5 chapters written by someone who's still $20K in debt.)

Part 2 - Understanding Why Money Feels Hard: expert breakdown of the psychology of money shame, why traditional budgeting fails, and the comparison trap that's keeping you stuck (This is where you realize it's not just you.)

Part 3 - Money Fundamentals for Real Life: comprehensive instructions on looking at your actual situation without panic, tracking without judgment, understanding debt, and building emergency funds when you're already struggling (7 chapters of what's actually working for me.)

Part 4 - Systems That Work: detailed walk-through of tracking that doesn't feel like punishment, budgeting when you have kids, debt payoff strategies (avalanche vs snowball), and saying no to friends when money is tight (This is the practical stuff you can implement immediately.)

Part 5 - Dealing With The Emotional Stuff: step-by-step crisis protocol for when you can't pay bills, scripts for talking to creditors, managing financial anxiety day-to-day, and what to do when you mess up (Because you will. I do every week.)

[bonus] a full Notion Template Hub for tracking everything in one digital dashboard.

[bonus] complete appendices including budget categories, bill tracking checklist, debt payoff comparison calculator, emergency resources directory, and a glossary of financial terms in plain English (No jargon. Just real explanations.)

Please note: No payment plans are available at this time. Results may vary and are not guaranteed. Due to the digital nature of this product, we do not offer refunds unless you've completed the 7-day quick start and done the 3-minute check-in for 4 weeks without any progress.

Here's what happens when you get this system:

First, I'll show you how to finally look at your bank account without the shame spiral—even if you haven't checked it in weeks and you're terrified of what you'll see.

Next, I'll guide you step-by-step through your first week with 15-minute daily actions so you don't get overwhelmed (Day 1: Just download and breathe. Day 3: Enter ONE number. That's it.)

Then, I'll teach you the 3-minute weekly system that keeps you from avoiding (This takes less time than deciding what to watch on Netflix, and it's the only thing that's stuck for me in 6 months.)

Lastly, I'll share the exact tracking and debt payoff strategies I'm using while still being $20K in debt (No "I paid off $200K and retired early" fantasy. Just real-life systems for real-life struggles.)

Just fill out your info below to get access:

Price: $47

One-time payment. Instant digital download. Keep forever.

✓ 200+-page complete guide

✓ 3-minute weekly check-in system

✓ Excel tracker with formulas

✓ 7-day quick start guide

✓ Notion template

✓ All appendices and resources

I'M READY TO STOP AVOIDING!

Couldn't load pickup availability